In the realm of economics, a bubble is like a ghost haunting the market—an unwarranted surge in the prices of a commodity that eventually leads to its own demise. One such phenomenon that has left its mark on the financial landscape is the real estate bubble. Imagine a rapid ascent in property prices, driven by an unprecedented demand or speculative frenzy, only to be followed by a sharp and unexpected plunge.

The bubble manifested in various nations, notably in the United States. Here, banks extended their reach by offering financing and approving high-risk mortgages for real estate. This sparked a surge in interest for real estate investments, escalating demand for properties and causing a spike in real estate prices.

Subsequently, certain borrowers found themselves incapable of meeting their repayment obligations to the banks, leading to the announcement of bankruptcy for some… This financial downturn is famously recognized as the subprime mortgage crisis of 2008.

In this blog post, we’ll delve into the intricacies of the real estate bubble, exploring its origins, the factors that fuel its growth, its relations to the Egyptian market, and the catastrophic aftermath when it bursts. Join me on this journey as we unravel the story of the real estate bubble and its far-reaching implications.

Unraveling the Socio-Economic Impact

The influence of the real estate bubble on the economy extends well beyond the confines of the property market, casting its impact across the broader economic panorama. The upsurge in property prices resulting from the real estate bubble compels individuals to explore avenues for repaying their mortgages, inevitably impacting their quality of life. With the relentless climb in real estate prices, the bubble expands, reaching a purchasing power threshold that remains out of reach for the majority.

The continual elevation of property values gives rise to a disparity, where numerous properties saturate the market with limited demand, primarily due to the inflated price range. This scenario makes the price dynamics inaccessible for a substantial portion of the population, underscoring the profound socio-economic ramifications of the real estate bubble.

A real estate bubble refers to an unwarranted surge in real estate prices, often followed by a notable and substantial decline. This phenomenon carries significant implications, particularly considering the widespread use of real estate as collateral for various forms of loans. Whether directly issued to individuals or indirectly through securitization and bonds backed by property securities, these loans become highly vulnerable in the face of a fundamental decline in property prices.

This vulnerability arises as the diminished property values may render them insufficient to cover the entire value of the loan facility, bond, or any financing method utilized.

Devastating Consequences of a Burst Real Estate Bubble

The repercussions of the real estate bubble are manifold, giving rise to risky behaviors that have profound and widespread consequences. One alarming consequence is the surge in ill-informed speculation within the real estate market, with individuals acquiring properties beyond their financial means through loans that surpass their monthly income capabilities.

The abrupt escalation in real estate prices creates a barrier for those in immediate need, rendering them unable to make a purchase even if they recently had the necessary funds. This not only disrupts individual aspirations for property ownership but also has a cascading effect on the economy at large.

The impact of a real estate bubble transcends the confines of the property market, permeating the entire economic landscape. This, in turn, may lead individuals to resort to imprudent loans and credit options as they grapple with the aftermath of the bubble burst. Sadly, when the bubble does burst, the fallout is severe, resulting in widespread homelessness and the depletion of hard-earned savings for many.

The damage inflicted by the real estate bubble is not confined to bricks and mortar; it leaves a lasting imprint on the financial stability and well-being of countless individuals and families.

Moreover, the substantial downturn can have cascading effects even if borrowers are willing to repay the loans. If the value of the loans surpasses that of the property itself, the asset in question, repayment becomes challenging. This scenario places financial institutions at risk of incurring substantial financial losses, impacting their income statements. The ramifications of a real estate bubble extend beyond the realm of property values, intricately intertwining with the financial stability of institutions and borrowers alike

Navigating the Dynamics of Real Estate Financing in the Bubble

The correlation between financing loans and the real estate bubble lies in the intricacies of interest rates and the ease of obtaining loans. A reduction in interest rates on real estate financing loans, coupled with a laxity in approving loans for individuals lacking the financial capacity to repay, stimulates a surge in real estate demand. This heightened demand propels real estate values to surpass their intrinsic worth.

When individuals financially ill-equipped for mortgage repayments default on their loans, the market experiences an imbalance—supply surges while demand dwindles—ultimately leading to the burst of the real estate bubble. Post-bubble burst, banks, having learned from the repercussions, adopt a stricter stance in approving real estate loans for those unable to meet mortgage obligations. This shift in approach further contributes to the decline in demand, perpetuating the aftermath of the burst real estate bubble.

The Reliability of Real Estate Investment in Turbulent Markets

According to experts, the current market presents an opportune time for real estate investment, particularly if pre-negotiated discounts or special offers are available. They emphasize that, despite the necessity of avoiding high prices, real estate remains the safest and most reliable avenue for savings when compared to other investment options.

However, to ensure a successful investment, it is crucial to select a reputable project and a trustworthy real estate developer. Thoroughly examining the company’s track record in project implementation and delivery, as well as validating licenses and building permits, is essential to preemptively address any potential issues during project execution or handover.

While some individuals opt to wait for a clearer market vision and stable prices, real estate investment endures as a resilient and secure option.

Despite the impact of inflation and fluctuations in the price of the dollar on real estate values in Egypt, the noticeable upswing in the Egyptian real estate market has not deterred its status as a reliable investment haven. Throughout major economic fluctuations that have adversely affected alternative investments, the real estate sector has demonstrated resilience and even yielded significant returns for investors during times of crisis.

Does the real estate bubble threaten the Egyptian real estate market?

Experts confirm that a real estate bubble is unlikely to occur in Egypt, for several reasons, including:

Speculation or bank financing of real estate is not widespread in Egypt, and therefore it is unlikely that the American bubble scenario will be repeated in Egypt, because real estate financing in Egypt is individual and self-financing carried out by individuals and companies, not banks.

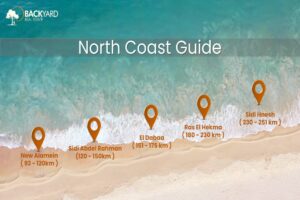

The expansion of real estate investment in Egypt is a logical and natural expansion, due to the continuous population increase in Egypt, the high population density and the tendency to expand in new cities. Statistics also show that Egypt needs approximately 500 thousand units annually for new marriages only. Therefore, increasing real estate investment and expansion in new cities will not cause a crisis because it is proportional to the increase in demand.

Real estate prices are consistent with their real value, as real estate prices increased due to the flotation and the decline in the value of the pound, and to the lifting of fuel subsidies, which was followed by an increase in the prices of building materials and thus an increase in the cost of building units, with an increase in the price of land sold by the Ministry of Housing to investors, and therefore the price increase also increased.

Therefore, the real estate market in Egypt may face a crisis in purchasing power, but that does not mean the existence of a real estate bubble in Egypt. As it is said about the real estate market in Egypt, it “gets sick and does not die.”