Over the years, Dubai has gained popularity as a prime investment destination among affluent individuals and business leaders. This can be attributed primarily to its lenient regulations, streamlined bureaucracy, and ambitious real estate projects. However, in the past two years, various geopolitical factors and the impact of pandemics have dampened demand. Nevertheless, Dubai’s real estate market is currently in a phase of recovery. Through careful planning, several measures have been implemented to minimize market fluctuations.

Speaking on this subject, it is projected that Dubai’s real estate market will reach its peak in 2024. High-end property prices are anticipated to increase from 6% to 7.9% this year, surpassing the growth rates of both Miami and Milan. With investor-oriented strategies in place, Dubai’s rental market is poised for significant expansion and development.

Various factors exert influence on the demand for real estate in Dubai, creating a dynamic and ever-changing market.

The present condition of the real estate market in Dubai

To assess the current state of Dubai’s real estate market and provide a forecast, it’s crucial to examine various perspectives carefully. Understanding the existing landscape of Dubai’s real estate market is essential before delving into future prospects. One of the significant drivers behind the flourishing Dubai real estate market is its strategic location.

The city is strategically positioned, offering excellent connectivity to the Middle East, Europe, and Asia. Consequently, Dubai’s real estate market attracts individuals from across the globe, transforming it into an international business hub.

Additionally, the government has adopted a transparent approach to its rules and regulations, fostering an investor-friendly environment that encourages real estate development. This has, in turn, bolstered the region’s economic growth. Dubai’s outstanding connectivity to the global stage and its robust infrastructure have solidified its status as the premier destination for real estate investors.

Here are the primary factors that impact real estate demand in Dubai

Economic Growth and Stability

Dubai’s robust and stable economy significantly drives the demand for real estate. Economic growth leads to higher incomes for the public, enabling them to invest in fixed assets such as properties and homes. This, in turn, results in increased demand for both residential and commercial properties.

Population Growth and Demographics

Dubai experiences continuous population growth, driven by international migration and a growing expatriate community. The expanding population fuels the demand for housing, and as the population increases, businesses expand, creating additional demand for commercial spaces.

Tourism and Hospitality Sector

Dubai’s status as a global tourist hotspot attracts millions of visitors annually. This influx of tourists boosts the demand for hotels, resorts, and serviced apartments, presenting significant opportunities for real estate developers and investors.

Government Policies and Regulations

The UAE government’s accommodating rules and policies have been instrumental in stimulating real estate demand. Special provisions and attractive housing schemes for non-residents, tax regulations, and simplified paperwork processes all contribute to a favorable environment for real estate investment.

Infrastructure Development

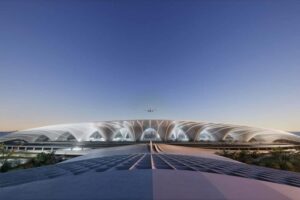

Dubai’s substantial investments in transportation networks, airports, ports, and public amenities have a profound impact on real estate demand. Enhanced infrastructure improves the city’s connectivity, accessibility, and overall quality of life. Dubai’s world-class infrastructure solidifies its position as one of the most thriving communities globally.

Primary Factors Influencing the Demand for Real Estate in Dubai

Investment Appetite

The strong demand from investors plays a central role in propelling Dubai’s real estate market. Regardless of nationality, investors are drawn to high-end properties in pursuit of substantial returns on investment (ROI).

International Attractiveness

Dubai’s investment-friendly climate and lenient ownership and tax policies make it an enticing destination for foreign investors and international buyers. This contributes significantly to the demand in the real estate sector, particularly for Non-Resident Indian (NRI) investors and buyers.

Local Investor Engagement and Diversification

Local investors in Dubai display a robust appetite for real estate investments. They actively invest in various properties as part of their investment strategies to diversify their portfolios and generate income. This enthusiastic local investment climate encourages developers to expand their residential and commercial property offerings.

Lifestyle and Quality of Life

Dubai’s appeal lies not only in its real estate but also in its high-quality lifestyle. The city boasts luxurious amenities, world-class entertainment options, and a vibrant social scene. Its cosmopolitan environment, coupled with strong safety and security measures, makes Dubai a magnet for individuals and families seeking an exceptional quality of life.

Amenities, Facilities, and Community Offerings

The presence of amenities, facilities, and community features contributes to increased demand in the real estate market. Properties with well-developed infrastructure, convenient locations, and a range of amenities are highly sought after.

Proximity to Key Points of Interest and Services

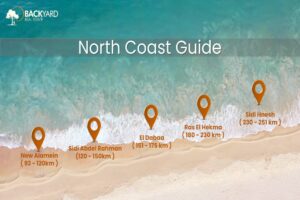

Properties located in close proximity to significant attractions like beaches, golf courses, iconic landmarks, and business districts tend to experience high demand. Additionally, properties situated near airports, metro stations, and major highways are considered desirable.

Rental Yield and Return on Investment (ROI)

Rental yield and the potential for ROI are essential factors for investors. Properties in high-demand areas developed by reputable builders are favored by investors.

Rental Income Potential and Market Dynamics

The potential for generating rental income is a significant driver of real estate demand in Dubai. It is often preferring rental apartments to generate income from their investments. High rental income and market trends make such properties highly appealing to investors.

Prospects for Capital Appreciation

Dubai’s real estate market has a history of notable capital appreciation, which attracts investors seeking the potential for long-term value appreciation.

Currency Exchange Rates

Dubai’s real estate market is inherently international, attracting investors from diverse nations. Currency exchange rate fluctuations can have a significant impact on the affordability of properties for foreign investors. When the local currency is strong, it can make properties more costly for international buyers, potentially influencing demand.

Dubai’s real estate market is subject to a complex interplay of economic, social, and political factors. Understanding the dynamics driving property prices is essential for those contemplating investments or transactions in this dynamic market. A multitude of factors, ranging from economic indicators to government policies and global events, contribute to the rise and fall of real estate prices in Dubai.

Staying well-informed about these factors empowers individuals to make informed decisions aligned with the current conditions of the market. Whether you are a prospective buyer, seller, or investor, vigilantly monitoring these elements will assist you in navigating the ever-evolving landscape of Dubai’s real estate market.

Factors Influencing Dubai’s Real Estate Market Forecast

Several factors contribute to the growth and dynamics of Dubai’s real estate market:

Affordable Housing: Developers are implementing more affordable housing projects to accommodate a broader segment of the population. This presents attractive investment opportunities by offering cost-effective apartments and addressing the demand for co-working spaces, townhouses, and eco-friendly buildings.

Political Stability: The stability of the government plays a pivotal role in shaping Dubai’s real estate market. Political stability provides investors and developers with a predictable market environment, making Dubai an attractive destination for investment.

Government Regulations: Dubai’s government has implemented regulations to enhance transparency in the real estate market. These regulations include restrictions on property purchases and loan amounts, helping maintain equilibrium in the market.

Population Growth: A growing population drives demand for real estate properties, creating more investment prospects in Dubai.

Oil Prices: Dubai’s economy benefits from revenue generated by the oil industry. High oil prices improve economic conditions, leading to increased property demand. Conversely, declining oil prices can impact both property demand and the economy.

Foreign Investment: Foreign investment has significantly contributed to Dubai’s thriving real estate market. Diverse perspectives and capital injections have enabled the market to cater to various segments of society.

Interest Rates: Interest rates play a crucial role in Dubai’s real estate market. High interest rates can make property investments more expensive for investors, potentially decreasing demand. Conversely, low-interest rates facilitate home purchases, contributing to the growth of Dubai’s real estate market.