In light of recent economic shifts, the conversation around investment strategies and the pursuit of reliable, stable income streams has taken center stage in Egypt. It’s not just about seeking high returns; the focus is on establishing financial steadiness and security through investments. Every industry has recently encountered unexpected and irregular price fluctuations.

The increasing value of the dollar against the Egyptian pound has led to continual price escalations, affecting various sectors, including real estate, due to rising construction material costs. This has notably impacted the daily lives of citizens with a significant surge in commodity prices. Given this landscape, individuals are exploring avenues to safeguard their capital or explore profitable investment opportunities.

In this blog, we’ll explore safe and lucrative investment options in the near future, questioning whether real estate stands as the optimal choice or if gold might offer a more promising opportunity.

Essential Factors for Investment Decision-Making

The investment decision is fundamentally a personal one, where a single answer or approach doesn’t fit everyone. It hinges on a set of factors that vary from one person to another. However, we can guide you on how to evaluate your investment decision.

The individual’s income level stands as a paramount factor in the investment decision. Making an investment without a stable income source that allows the accumulation of capital for investment without risk is unfeasible.

Once you’ve determined your income source and have a stable amount, the next step is to assess the portion of funds you can regularly save without compromising your financial needs.

When choosing an investment field, it’s essential to evaluate your familiarity and ability to keep track of it, to avoid potential losses or falling victim to fraud due to lack of knowledge or experience in that domain.

The best investment of money in Egypt

In the current context, investing has become an essential consideration for those with the opportunity. Recent changes have made retaining money in its liquid form a risky prospect as its value depreciates over time, notably demonstrated in the recent crisis due to the sharp rise of the dollar against the pound.

There are diverse investment options available, each presenting unique characteristics, advantages, and disadvantages. Choices include:

Bank Deposits and Certificates

Investing in bank certificates and deposits offers a secure haven where funds are guaranteed and you’re not at risk of losing them. Interest rates are fixed, varying in duration from one to five years, but they demand your funds to remain untouched for a specified period to receive the complete interest, and they don’t promise substantial profits.

Business Projects

Embarking on commercial ventures stands as a successful means of continuous income, especially during challenging times. Initiating a profitable business idea in the market is crucial. While it allows freedom in choosing a field, it comes with challenges, notably competition and establishing a unique business identity. Managing a business demands time, effort, and capital, with steady profits taking time to materialize.

Investing in Gold

The term ‘gold prices today’ has topped internet searches in Egypt over the last three months, reflective of the unprecedented surge in gold prices every hour. The hike in gold prices directly mirrors the inflationary state of the economy, leading to increased buying demand and subsequently a shortage in the market.

Investing in gold is not a recent phenomenon; it’s among the oldest traditional ways people safeguard their savings by purchasing gold jewelry, bullion, or coins. Families often convert their liquidity into gold.

Benefits of Investing in Gold

Flexibility: You’re not obligated to invest a specific amount; you can start with small purchases like jewelry, small bars, or gold coins in sizes as small as a quarter or one gram.

Incremental Investment: You can continuously increase your investment by making periodic gold purchases from a trusted dealer.

Easy Transactions: You can sell gold whenever needed without complicated procedures.

Global Commodity: It’s a universally accepted commodity, facilitating purchase or sale internationally.

Low Maintenance: Gold doesn’t burden you with maintenance costs and retains its material value unlike currencies.

Transparent Pricing: Gold prices are easily accessible through simple online searches for daily rates.

Drawbacks of Investing in Gold

Time for Returns: While instant profits are possible, significant returns may take at least a year or more.

No Passive Income: Gold isn’t a source for passive income; it cannot be rented out or utilized for projects.

Market Fluctuations: Sudden drops in gold prices due to market movements might deter sales at certain times.

Investing in Real Estates

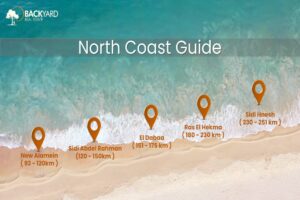

Real estate investment may have been distant from the thoughts of many for a long time, but in recent years, the market has emerged as a lucrative and steadfast avenue for those seeking to invest their funds. Egypt’s real estate market owes its strength to the high demand for properties, with millions searching for housing annually. Additionally, the government’s recent focus on urban expansion, seen through projects like the New Administrative Capital and New Alamein, emphasizes the sector’s potential.

Since 2021, the real estate market in Egypt has seen a significant revival. Despite the surge in building material costs and property prices, Egyptians continue to show a consistent interest in property acquisition. In the current economic climate marked by high inflation and the devaluation of the Egyptian pound against the dollar, the real estate sector claims a substantial portion of Egypt’s total investments, amounting to 65% of investors’ preference over other options like gold and the stock market. With over 13 million housing units in Egypt and an approximate 30% deficit in residential properties, the real estate sector stands out as the primary investment choice

Benefits of Real Estate Investment

Rental Income and Steady Profits: Real estate investment can generate consistent earnings through property rentals.

Growing Investment Scale: Real estate investments involve substantial and continually growing capital.

Persistent Market Demand: The ongoing demand for properties ensures a dynamic market, safeguarding your funds.

Stable Property Values: Real estate values exhibit less volatility compared to gold.

Property Utilization: Real estate can serve personal or project-based purposes.

Diverse Property Types: Each, whether residential or commercial, offers specific advantages supporting your investment.