Investing in real estate involves more than just property acquisition; it’s a strategic financial decision that necessitates meticulous planning and profound understanding. In a diverse market like Dubai, the potential for both gain and risk is substantial. Mastering the nuances of real estate investment can provide a stream of passive income, cultivate long-term wealth, and serve as a tool for expanding one’s investment portfolio.

This guide is designed for those eager to navigate the realm of real estate investment in Dubai, whether they are newcomers or experienced investors seeking to diversify their holdings in the Emirate.

Diverse Real Estate Investment Options

Dubai’s real estate landscape offers a range of investment opportunities:

Residential Properties: These encompass villas, apartments, and townhouses.

Pros: Reliable rental income; potential for value appreciation.

Cons: Property management requirements; oversaturation in certain areas.

Commercial Properties: This category includes offices, retail spaces, and warehouses.

Pros: Longer lease terms; higher rental yields.

Cons: Larger initial investment; vulnerability to economic downturns.

REITs (Real Estate Investment Trusts): These are firms that own or finance real estate across various sectors.

Pros: Liquidity; consistent dividends.

Cons: Susceptibility to market fluctuations; limited control.

Crowdfunding: Collaboratively pooling funds online to invest in real estate projects.

Pros: Access to larger investments; portfolio diversification.

Cons: Risk of platform insolvency; reduced control over investments.

Establishing Investment Objectives

Investing without well-defined objectives is akin to making blind guesses. Whether your aim is to secure rental income, speculate on property appreciation, or plan for retirement, having clear goals is crucial to guide your investment decisions. By outlining your objectives, you can tailor your investment strategies to ensure your financial aspirations align with your risk tolerance.

Financial Preparedness

Prior to venturing into the property market, it’s essential to have your financial house in order:

Down Payment: Typically, be prepared to set aside 20-30% of the property’s value.

Credit Score: A higher credit score can help you secure more favorable loan terms.

Leverage: In real estate, leverage enables you to purchase property with borrowed funds, potentially optimizing your return on investment. However, it’s vital to borrow responsibly within your means.

Budgeting and Emergency Funds: Always account for potential vacancies or unforeseen maintenance costs.

Market Analysis and Location

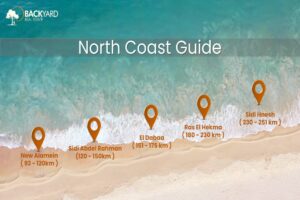

Dubai’s real estate market is not uniform; each area, from the bustling Marina to the tranquil Springs, caters to different demographics. Comprehensive market research is essential to comprehend rental yields, occupancy rates, and potential property appreciation. Keep in mind that in real estate, the mantra is “location, location, location.” Your investment’s success often hinges on this critical choice.

Property Selection and Evaluation

Selecting investment properties involves considering specific criteria:

Condition: Is the property ready for occupancy, or does it require renovations?

Rental Yield: What is the anticipated rental income potential?

Neighborhood: Proximity to amenities can significantly influence rental demand.

Performance metrics such as the capitalization rate (cap rate), cash-on-cash return, and return on investment (ROI) are essential tools for assessing a property’s potential profitability.

Financing Choices

In Dubai, there are several options for financing your real estate investment:

Mortgages: These are conventional bank loans with varying interest rates.

Hard Money Loans: Short-term loans that are asset-based and typically carry higher interest rates.

Seller Financing: In this scenario, the seller acts as the lender.

Each financing method has its advantages and disadvantages, so it’s essential to assess them in light of your specific investment objectives.

Property Management

Being a landlord in Dubai entails various responsibilities, including:

Tenant Screening: Ensuring you have reliable and on-time rent payments from tenants.

Maintenance: Keeping the property in excellent condition to retain its value.

Legal Obligations: Understanding tenant rights and lease agreements to operate within the bounds of the law.

If you prefer not to handle these responsibilities personally, you can opt for property management services to oversee these aspects on your behalf.

Risk Management

All investments come with a degree of risk, and real estate is no exception. Potential risks include:

Market Fluctuations: Property values can decrease.

Vacancies: Rental income is not guaranteed, and vacant periods can occur.

However, diversifying your real estate portfolio and obtaining the appropriate insurance coverage can help mitigate these risks.

Tax and Legal Aspects

Real estate investments in Dubai come with tax implications, which may include deductions on mortgage interest. Additionally, it’s crucial to consider property ownership structures, such as LLCs, and become well-versed in local property regulations.

A Long-Term Approach

Real estate is often a long-term game. The tangible nature of property, its potential for generating passive income, and the prospect of appreciation make it a suitable choice for long-term investment. Cultivating patience can lead to substantial returns.

Dubai, with its captivating blend of tradition and modernity, presents a promising real estate market. While opportunities abound, it’s vital to embark on this journey well-informed and with a clear strategy. With the right approach and diligent effort, your investment in Dubai’s real estate market can be a pathway to financial success. Take the plunge, but do so with your eyes wide open.

How to Avoid Problems When Buying Property in Dubai?

Investing in real estate in Dubai can be a lucrative opportunity, but like any investment, it comes with potential pitfalls.

Here are some key steps to avoid common problems when buying property in Dubai:

Verify Real Estate Agent’s Registration: Ensure that the real estate agent or property developer you are dealing with is registered with the Real Estate Regulatory Authority (RERA). This registration ensures that they are legally authorized to operate and can be trusted.

Check Paperwork: Make sure that all the necessary paperwork is in order. This includes a Memorandum of Understanding (MOU) and a No Objection Certificate (NOC). These documents are crucial for legal property transactions.

Due Diligence on the Neighborhood: Do your research on the neighborhood where you plan to invest. Look into factors like infrastructure, amenities, and future developments. It’s essential to understand the area’s potential for growth and property value appreciation.

Compare Property Prices: Compare property prices and rental rates in the area you are interested in. This will help you avoid overpaying for a property and ensure that you are making a sound investment decision.

Consult with Experts: Consider seeking advice from real estate experts who have experience in the Dubai market. They can provide valuable insights into market trends, rental yields, and other crucial factors to make informed decisions.

By following these steps and conducting thorough research, you can minimize the risks associated with buying property in Dubai and make a more informed investment choice. Consulting with experts can be particularly helpful in navigating the Dubai real estate market successfully.

Leverage Expert Advice for Successful Dubai Real Estate Investment

Investing in Dubai’s real estate market is a significant undertaking, and expert advice can be a game-changer for your success. Here’s why you should consider seeking guidance from real estate professionals:

Property Identification: Experienced advisors can help you identify properties that align with your investment goals. They have a deep understanding of the market and can pinpoint opportunities that match your criteria.

Risk Assessment: Real estate experts can assess the risks associated with specific investments. They provide valuable insights into potential challenges and how to mitigate them, ensuring a more secure investment.

Market Insights: Professionals keep a close eye on market trends and conditions. They can provide you with up-to-date information on market dynamics, helping you make informed decisions.

Education: Enrolling in courses like the Certified Training for Real Estate Brokers offered by the Dubai Real Estate Institute (DREI) can equip you with the knowledge and skills needed to navigate the complex real estate market confidently.

Maximize Returns: With the guidance of an experienced professional, you can strategize to maximize your returns. They can help you with pricing, negotiation, and other aspects that lead to a profitable investment.

By tapping into the expertise of real estate advisors and investing in your education, you can make well-informed decisions, reduce risks, and position yourself for success in Dubai’s dynamic real estate market