As developers and investors endeavor to optimize opportunities, strategic financing emerges as an indispensable element for success. With a robust economy, government support, population growth; investing in Egypt—especially within the real estate sector—present the potential for significant returns.

The Egyptian real estate market is a dynamic and promising sector and has emerged as a lucrative investment destination. Thanks to its unique mix of demographics and commercial links to the broader world, as well as its strategic location at the gateway of trade and commerce for Southern Europe, Africa and the Middle East. With over 100 million population makes it the largest Arab country.

Investing in Egypt : Key facts about Real Estate Sector in Egypt

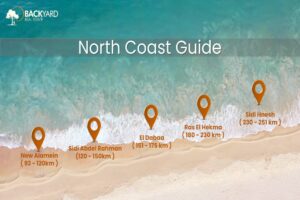

Before delving into financing strategies, it is essential to understand the unique dynamics of the Egyptian real estate market. Key cities like New Cairo and North Coast are hubs of economic activity, attracting both local and international investors.

The real estate market is influenced by factors such as population growth, urbanization, government incentives, economic stability, and infrastructure development. Recognizing these factors is crucial for investing in Egypt and planning effective financing strategies that align with market trends and potential risks.

1- Financing Options for investing in Egypt:

There are many financing options available for real estate investment, such as mortgages, bank loans, and developer financing.

- Traditional Bank Financing:

Traditional bank financing is the common way for real estate investing in Egypt. Banks offer various loan products with competitive interest rates. Investors can secure funds for land acquisition, construction, and project development. However, the approval processes and collateral requirements are factors that need careful consideration.

- Government Initiatives and Subsidies:

Government-backed initiatives and subsidies aim to promote real estate development. In Egypt, initiatives including the “Mortgage Finance Fund” and “Social Housing Program” provide financial support and incentives for affordable real estate projects.

- Islamic Financing:

Islamic financing follows Sharia principles, offering an alternative fundings for developers who seek financing in compliance with Islamic law. Real estate investing in Egypt has seen the emergence of Islamic banks and financial institutions that provide Sharia-compliant products, including Murabaha and Ijarah, suitable for real estate projects.

- Crowdfunding and Peer-to-Peer Lending:

With the rise of digital platforms, crowdfunding and peer-to-peer lending have become viable options for real estate financing. These platforms often provide flexibility in terms and conditions, catering to the specific needs of real estate projects.

2- Strategic Financial Planning

- Risk Mitigation:

A comprehensive financial plan should include risk mitigation strategies including feasibility studies. Long-term strategy is critical in real estate investments to manage the property assessing potential returns on investment and creating a possibility plan in case of any unexpected challenges.

- Diversification of Funding Sources:

To enhance financial resilience, consider diversifying funding sources by combining bank loans, government subsidies, and private equity.

- Adaptability to Market Trends:

A successful financing strategy should be adaptable to market trends as the real estate market is dynamic and subject to constant changes. Regularly monitor economic indicators, regulatory changes, and consumer preferences to adjust your financing approach accordingly.

3- Legal and Regulatory Framework:

- Investing in real estate in Egypt requires a nuanced understanding of the legal and regulatory framework governing the sector including registration processes, and the imperative need for compliance with local laws.

4- Prime Investment Hubs:

- Spotlight on Key Investment Hubs in Egypt: Cairo, Alexandria, Red Sea, and the North Coast.

- Evaluate Growth Opportunities, Rental Yields, and the Dynamics of Supply and Demand at Each Location.

5- Real Estate Investment Options:

- Investing in Egypt across diverse property categories, encompassing residential properties, commercial spaces, vacation homes, and industrial properties.

6- Deal with Real Estate Experts:

- Choose trustworthy real estate agents, brokers, property managers and legal consultants to facilitate in the investment process. These experts play a crucial role in aiding investors to locate the ideal property in the optimal location, oversee daily property operations, and provide essential legal counsel regarding real estate investments in Egypt.

Real estate investment in Egypt provides ample prospects for investors looking for promising returns and sustained long-term growth. The strong knowledge of market dynamics, the legal framework, investment options, and future trends is essential to make well-informed and strategic investment choices. Strategic financing is paramount for success in the Egyptian real estate market. As the market continues to grow, staying informed and innovative in financing approaches will be the key to sustained growth and profitability. In short, with careful research, risk assessment, and collaboration with real estate professionals, investing in Egypt especially in the real estate market will be a rewarding venture for both seasoned and novice investors.