Amid the ongoing economic and financial challenges, compounded by the devaluation of the Egyptian Pound against the US Dollar, it is evident that you are on the lookout for secure investment options to protect your capital with the assurance of minimal potential losses. Commercial real estate investment has emerged as the most secure method to preserve financial value in these uncertain times.

This prompts the question: Does real estate investment solely revolve around residential properties? The real estate market offers a broader spectrum. Have you contemplated the prospect of investing in commercial and administrative real estate?

Are you keen on delving into real estate investment but uncertain about where to commence? Are you in search of a method to generate returns that can contribute to securing your financial future? If that’s the case, commercial and office real estate investment might be the optimal choice. Explore how Egyptian commercial real estate investment can aid you in realizing your long-term objectives, and familiarize yourself with its potential returns.

What are the categories of commercial properties?

Office Spaces

Termed as office real estate, these properties are utilized for office buildings. This encompasses towering structures in urban areas, such as skyscrapers, along with office complexes and medium-sized facilities in suburban regions. Examples of tenants could include legal firms or emerging business ventures. Office spaces come in diverse sizes and arrangements. Lease durations for commercial properties are typically lengthier, often ranging from five to ten years.

Multi-Family Properties

Multi-family properties offer residential living spaces in exchange for rental payments. The term multi-family properties refers to buildings containing more than four apartments. These properties encompass residential buildings, housing complexes, cooperatives, as well as residential homes and apartments. Sizes and the quantity of units in these properties can vary significantly. Generally, multi-family lease agreements provide greater flexibility in terms of ownership. Lease contracts for residential properties can be either short or long-term, with rare extensions beyond a year. Some lease agreements may even be on a monthly basis.

Industrial Real Estate

Industrial real estate is utilized to accommodate industrial activities, including heavy manufacturing structures, storage facilities, assembly plants, and research and development facilities. Examples include oil refineries (heavy manufacturing), Amazon distribution centers (warehouses), product assembly factories, and pharmaceutical research and development facilities. Often, these properties are not established in locations ideal for residential real estate or retail centers, and their placement is determined by zoning laws related to industrial company activities. Lease terms for industrial real estate generally span five years or more.

Retail Properties

Retail properties enable retail companies to conduct broad-scale operations and typically include stores and restaurants. Shopping centers, factory outlets, and similar retail facilities are examples of large multi-tenant complexes. Sometimes, they may be standalone buildings with a single tenant. The local area influences the potential profitability of retail properties as it impacts tenants interested in establishing businesses there. Retail lease contracts typically range from 4 to 5 years.

Commercial Storefronts

Commercial storefronts are considered commercial real estate, allowing you to make informed decisions about purchasing a storefront for your business operations or real estate investment in Egypt. You can lease it to other companies or engage in resale activities, providing you with beneficial financial returns.

Core Factors Driving Investment in Commercial Real Estate

Consistent Financial Returns

Engaging in commercial and administrative real estate investment generally ensures a more reliable and higher level of financial returns compared to residential properties. This stability is attributed to extended lease agreements, potentially spanning up to a decade, guaranteeing a steady monthly income over an extended duration.

Increased Financial Profit

Profitability is notably elevated compared to residential properties, given that commercial properties command significantly higher rental rates. Prolonged lease terms facilitate periodic rent adjustments and annual increases, resulting in a considerable augmentation of income.

Reduction in Maintenance Expenses

Diverging from residential property investors, those involved in commercial investment benefit from cost savings on maintenance. In commercial or administrative leases, tenants bear the responsibility for property maintenance and repairs, as outlined in the respective lease agreements.

Professional Transactions

Commercial investments commonly involve dealings with tenants whose livelihoods depend on the property unit. Consequently, tenants have a vested interest in preserving the property and maintaining a positive rapport with the landlord, mitigating issues such as rent payment delays often encountered with residential tenants.

Secure Investment

The cumulative effect of the above points underscores the notion that investing in commercial and administrative real estate constitutes a secure venture. Unlike stock investments, properties retain their intrinsic value encompassing both the building and land. These tangible and resilient assets can be repurposed, influencing their valuation and worth.

Even in the face of tenant challenges or global adversities, as witnessed during the pandemic, the property’s value remains steadfast, steering clear of depreciation to zero.

The Primary 10 Gains from Investing in Commercial Real Estate

Consistent Income Generation: Investment in commercial real estate has the potential to generate a stable income flow through regular rental payments.

Asset Appreciation: The value of commercial properties tends to appreciate over time, presenting opportunities for capital gains upon eventual resale.

Tax Benefits: Investors in commercial real estate may be eligible for tax deductions, including depreciation, maintenance, travel expenses, and other related benefits.

Financial Leverage: Utilizing financial leverage, investors can acquire larger commercial properties with a reduced initial capital investment.

Portfolio Diversification: Commercial real estate investment diversifies portfolios by introducing an asset class less correlated with traditional stocks and bonds.

Long-Term Investment Strategy: Commercial properties are typically held for an extended period, ensuring investors stability and confidence in the security of their investments.

Professional Property Management: Expert property managers can handle the day-to-day operations of commercial real estate, allowing investors to focus on other aspects of their portfolios.

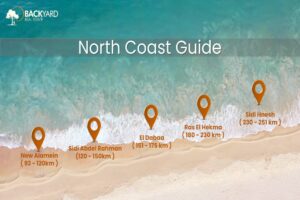

Strategic Location Impact: The location significantly influences the value of commercial assets. Investors should choose properties in desirable locations with excellent infrastructure and convenient access to amenities.

Minimal Vacancy Rates: While vacancies pose a concern in commercial real estate, many properties feature long-term leases, resulting in lower vacancy rates compared to residential investments.

Positive Cash Flow Projection: With increasing rents and favorable interest rates, numerous commercial real estate investments are expected to yield positive cash flows from the outset.

Return on Investment for Commercial Real Estate Units

Is commercial real estate investment a suitable choice for you? Are the returns attractive? Is the leasing duration fitting? And will you be responsible for expenses related to the completion of the commercial unit?

Initially, you must calculate the annual return on investment (ROI) for commercial real estate and compare it to the returns observed in residential properties, for instance.

In the context of commercial investment, when acquiring a store, office, or any commercial property for leasing purposes, the ROI tends to be more lucrative, starting at 8% and easily extending to 15% (or more in certain prime locations).

It’s essential to note that the leasing term for commercial spaces varies from residential property leases. Commercial lease contracts typically span from 3 to 10 years, while residential leases typically range from 3 to 5 years.

When purchasing an apartment, villa, or any residential property for leasing purposes, the ROI is calculated as follows:

Annual Rental Income= Monthly Rent × 12 months

Return on Investment= (Annual Rental Income – Expenses (maintenance and costs) ÷ Property Price) %